on October 27, 2014 in For Buyers

There are three questions you should ask before purchasing in today’s market:

1. Why am I buying a home in the first place?

This truly is the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with finances. A study by the Joint Center for Housing Studies at Harvard University reveals that the four major reasons people buy a home have nothing to do with money:- A good place to raise children and for them to get a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of the space

2. Where are home values headed?

When looking at future housing values, Home Price Expectation Survey provides a fair assessment. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.Here is what the experts projected in the latest survey:

- Home values will appreciate by 4% in 2015.

- The cumulative appreciation will be 19.5% by 2018.

- Even the experts making up the most bearish quartile of the survey still are projecting a cumulative appreciation of over 11.2% by 2018.

3. Where are mortgage interest rates headed?

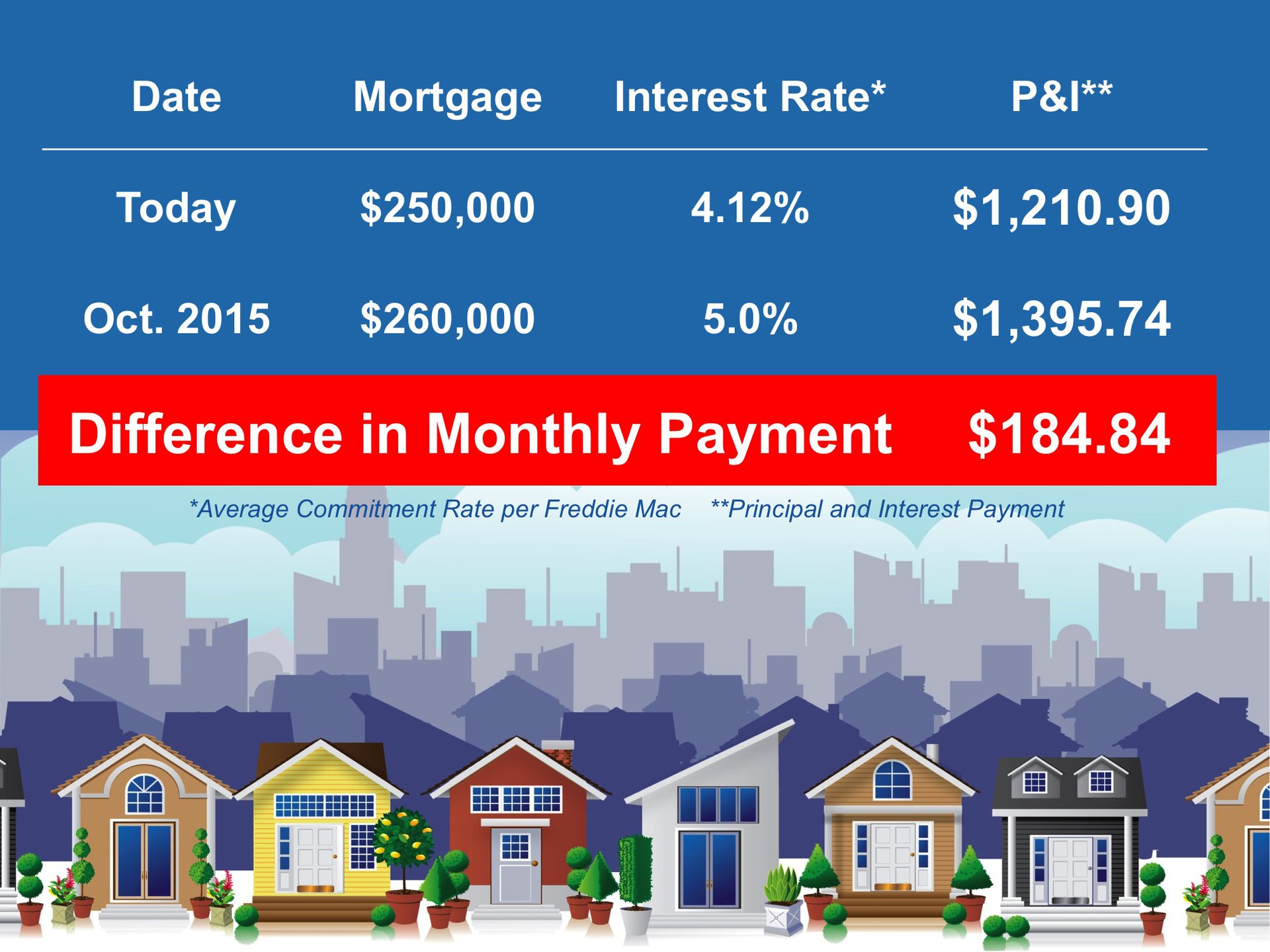

A buyer must be concerned about more than just prices. The ‘long term cost’ of a home can be dramatically impacted by an increase in mortgage rates.The Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac have all projected that mortgage interest rates will increase by approximately one full percentage over the next twelve months.