Some industry pundits are saying that the housing market may be heading for a slowdown. One of the data points they use is the falling numbers of the Housing Affordability Index, as reported by the National Association of Realtors (NAR).

Here is how NAR defines the index:

“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.”

<<DOWNLOAD YOUR FREE HOME BUYING GUIDE SUMMER 2016>>

Basically, a value of 100 means a family earning the median income earns enough to qualify for a mortgage on a median priced home, based on the price and mortgage interest rates at the time. Anything above 100 means the family has more than enough to qualify.

The higher the index the easier it is to afford a home.

Why the concern?

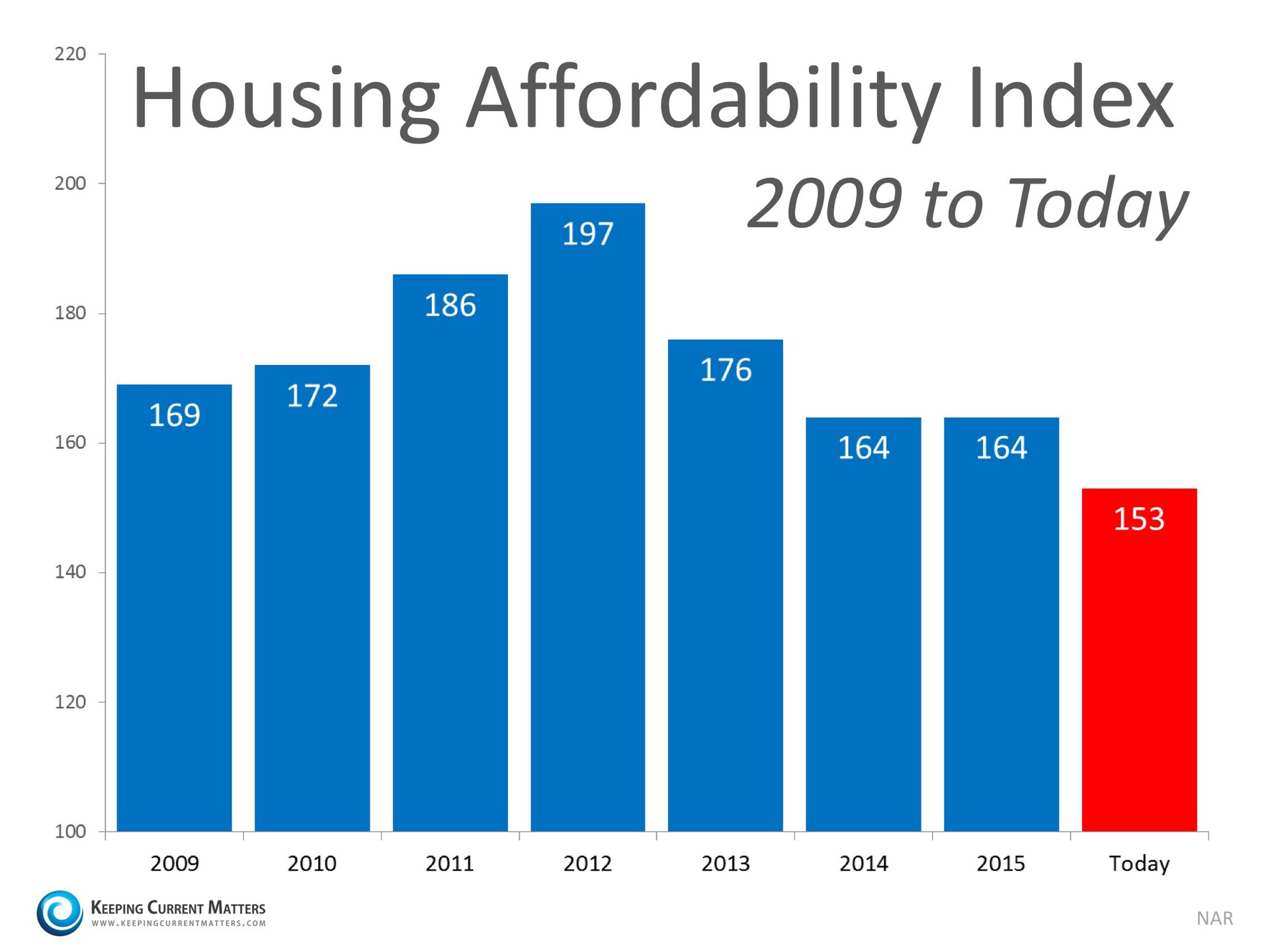

The index has been declining over the last several years as home values increased. Some are concerned that too many buyers could be priced out of the market. Here is a snapshot of the index since 2009:

But, wait a minute…

Though the index has decreased over the last four years, we must realize that at that time there was an overabundance of housing inventory and as many as one out of three listings was a distressed property (foreclosure or short sale). All prices dropped dramatically and distressed properties sold at major discounts. Then, mortgage rates fell like a rock.

The market is recovering and values are coming back nicely. That has caused the index to fall.

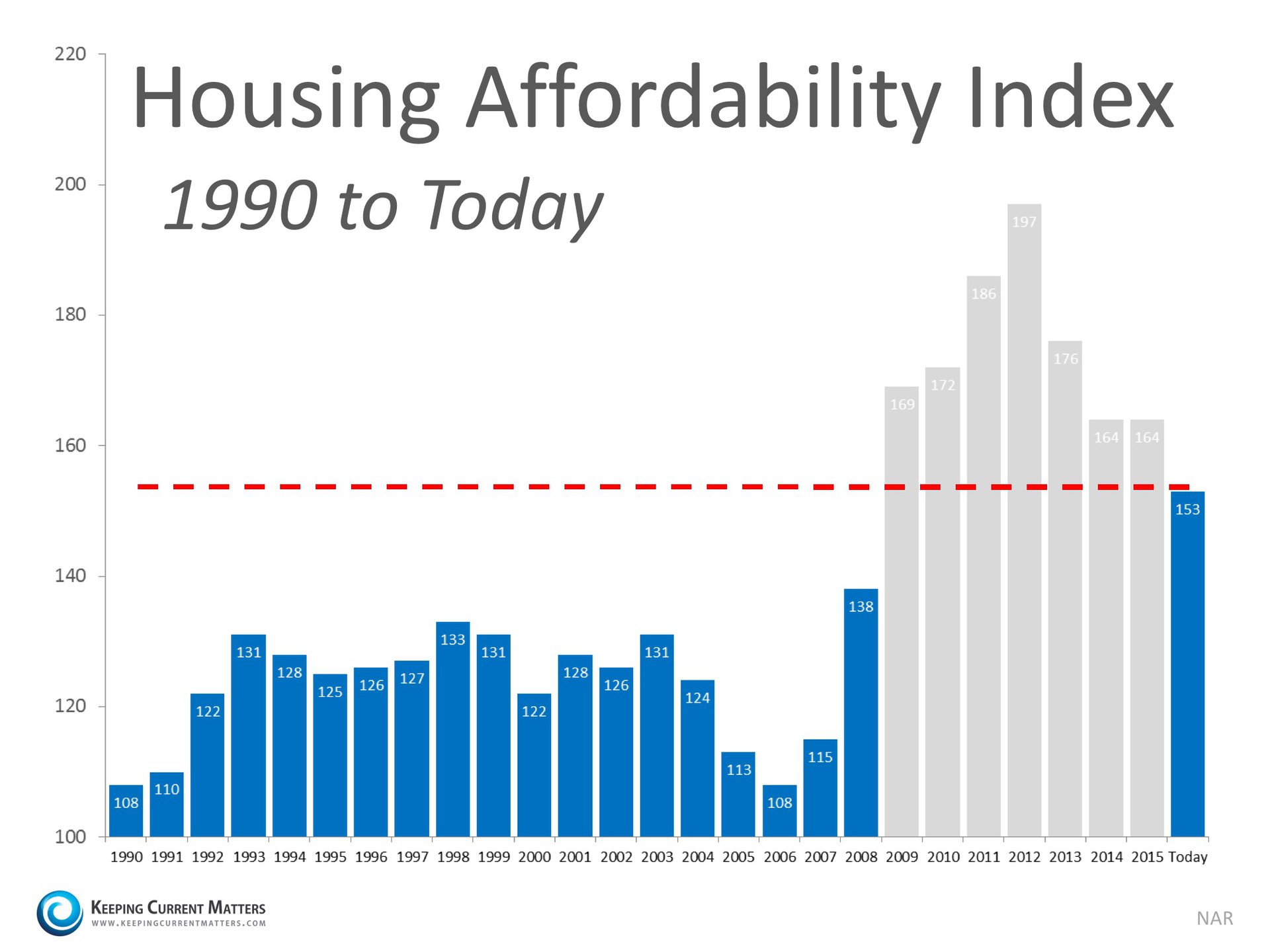

However, let’s remove the crisis years and look at the current index as compared to the index from 1990 – 2008. We can see that, even though prices have increased, historically low mortgage rates have put the index in a better position than every year for the nineteen years prior to the crash.

Bottom Line

The Housing Affordability Index is in great shape and should not be seen as a challenge to the real estate market’s continued recovery.

Whether you are thinking of Buying or Selling a Home contact a professional realtor who cares about you and your time. Contact Jay Cermak Top Fort Lauderdale Real Estate Agent at 954.235.3589 and schedule a FREE Real Estate Consultation today.

Whether you are thinking of Buying or Selling a Home contact a professional realtor who cares about you and your time. Contact Jay Cermak Top Fort Lauderdale Real Estate Agent at 954.235.3589 and schedule a FREE Real Estate Consultation today.