In a recent post, CoreLogic looked at the correlation between stocks and the sales of upper-end properties ($1 Million+ sales price). The report revealed:

“The powerful ‘wealth effects’ generated by the rapid rise in equities between 2009 and 2015 drove a large rise in the sales of homes that sold for $1 million or more.Historically, sales of homes priced $1 million or more averaged 1.2 percent of all home sales. The spread between high-end sales and equities widened during the housing bubble but then moved more closely in unison. By the time the equity markets had peaked in May 2015, the $1 million or more share of the market had nearly doubled, averaging 2.2 percent for the remainder of the year.”

<<SEARCH FORT LAUDERDALE HOMES FOR SALE>>

This makes sense. As people see their wealth increasing, they feel more confident in their purchasing power. And, of course, that would also impact their decisions regarding real estate. The stock market dipped earlier this year and there was quite a bit of anecdotal evidence that the upper-end market was beginning to soften.

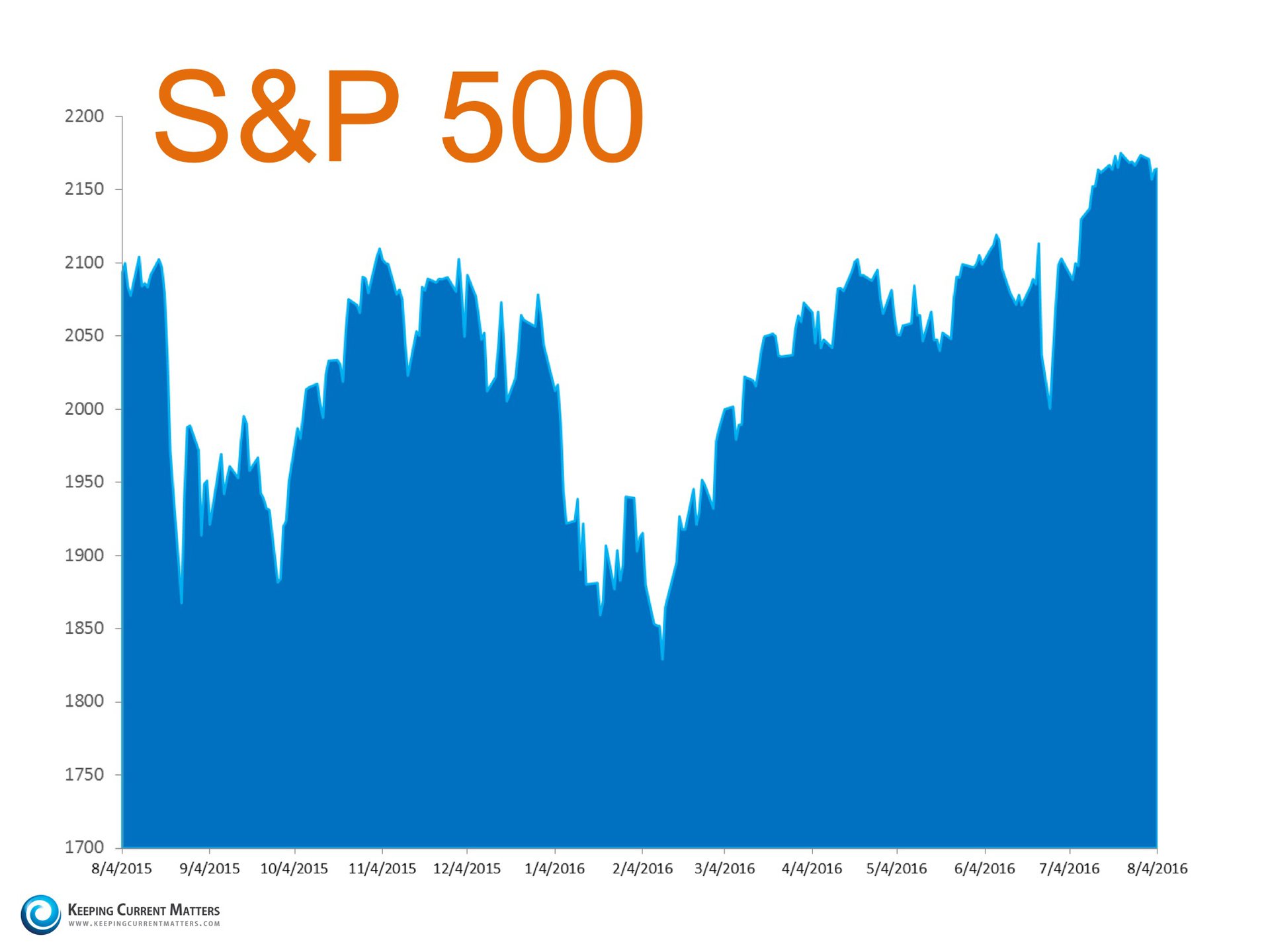

As we can see in the chart below, the market is again flourishing. That may rejuvenate the luxury market as we move through the rest of the year.

As we proceed through 2016 and enter 2017, the strength of the stock market will be a key factor in the strength of the luxury market. If the stock market falters, look for high-end sales to slow. If the market advances, as it has shown signs of doing most recently, the high-end market will advance.

Whether you are thinking of Buying or Selling a Home contact a professional realtor who cares about you and your time.

Contact Jay Cermak Top Fort Lauderdale Real Estate Agent with Keller Williams Realty at 954-235-3589 and schedule a FREE Real Estate Consultation.

Serving all of your South Florida and Fort Lauderdale Real Estate Needs!

No comments:

Post a Comment