If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following 3 questions to help determine if now is actually a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This truly is the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a recent survey by Braun showed that over 75% of parents say “their child’s education is an important part of the search for a new home.”

This survey supports a study by the

Joint Center for Housing Studies at Harvard University which revealed that the four major reasons people buy a home have nothing to do with money. They are:

- A good place to raise children and for them to get a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

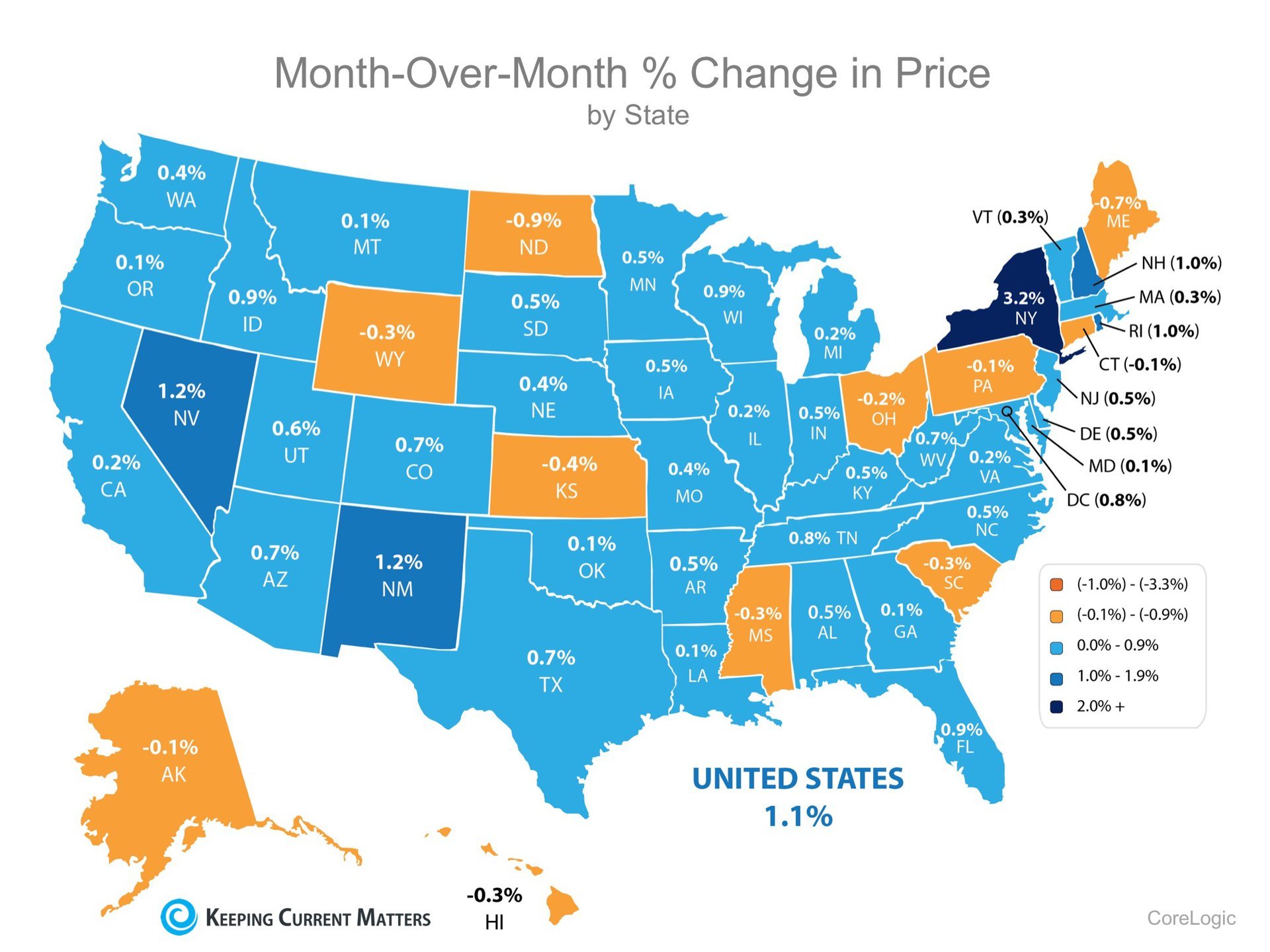

2. Where are home values headed?

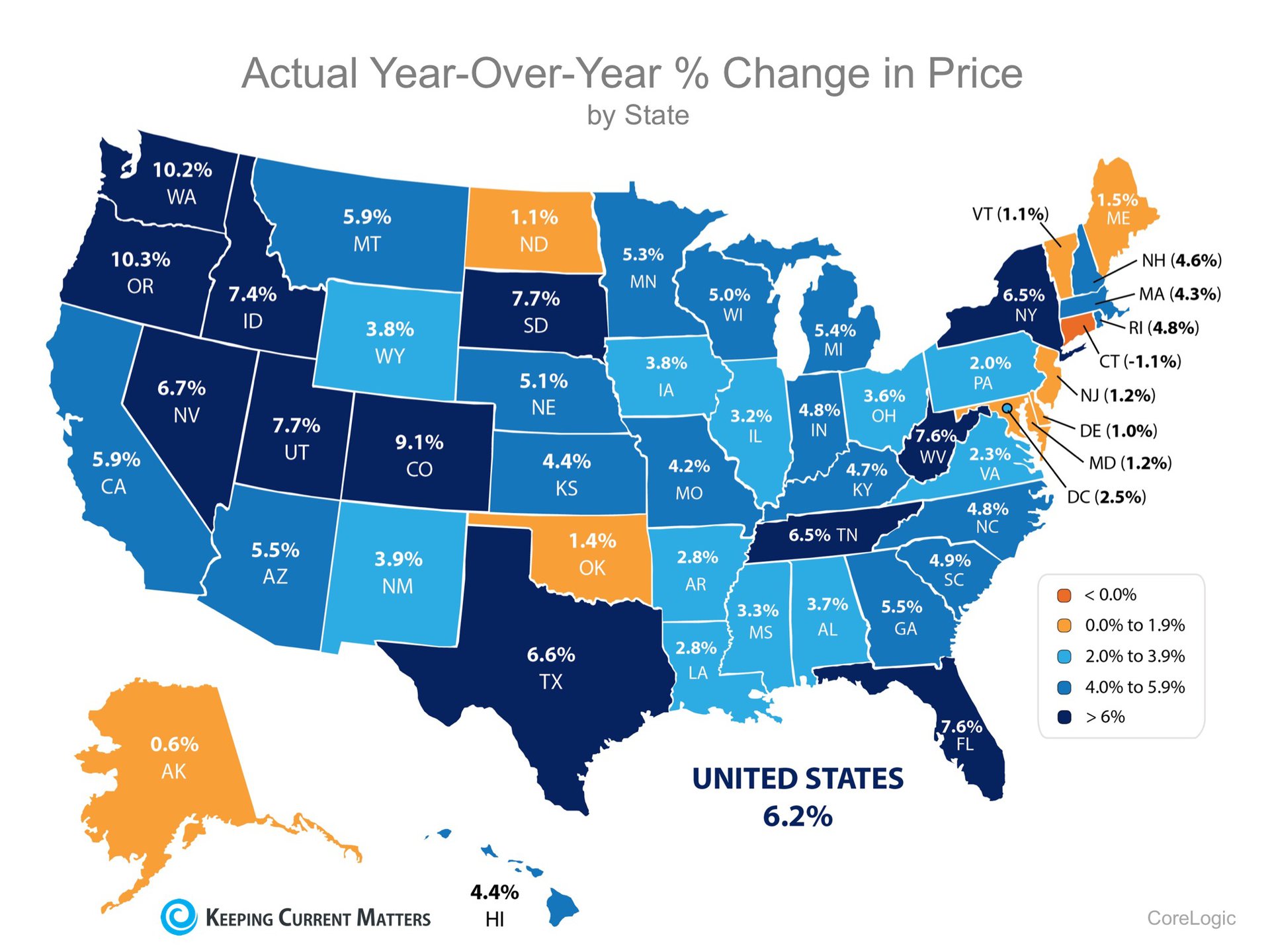

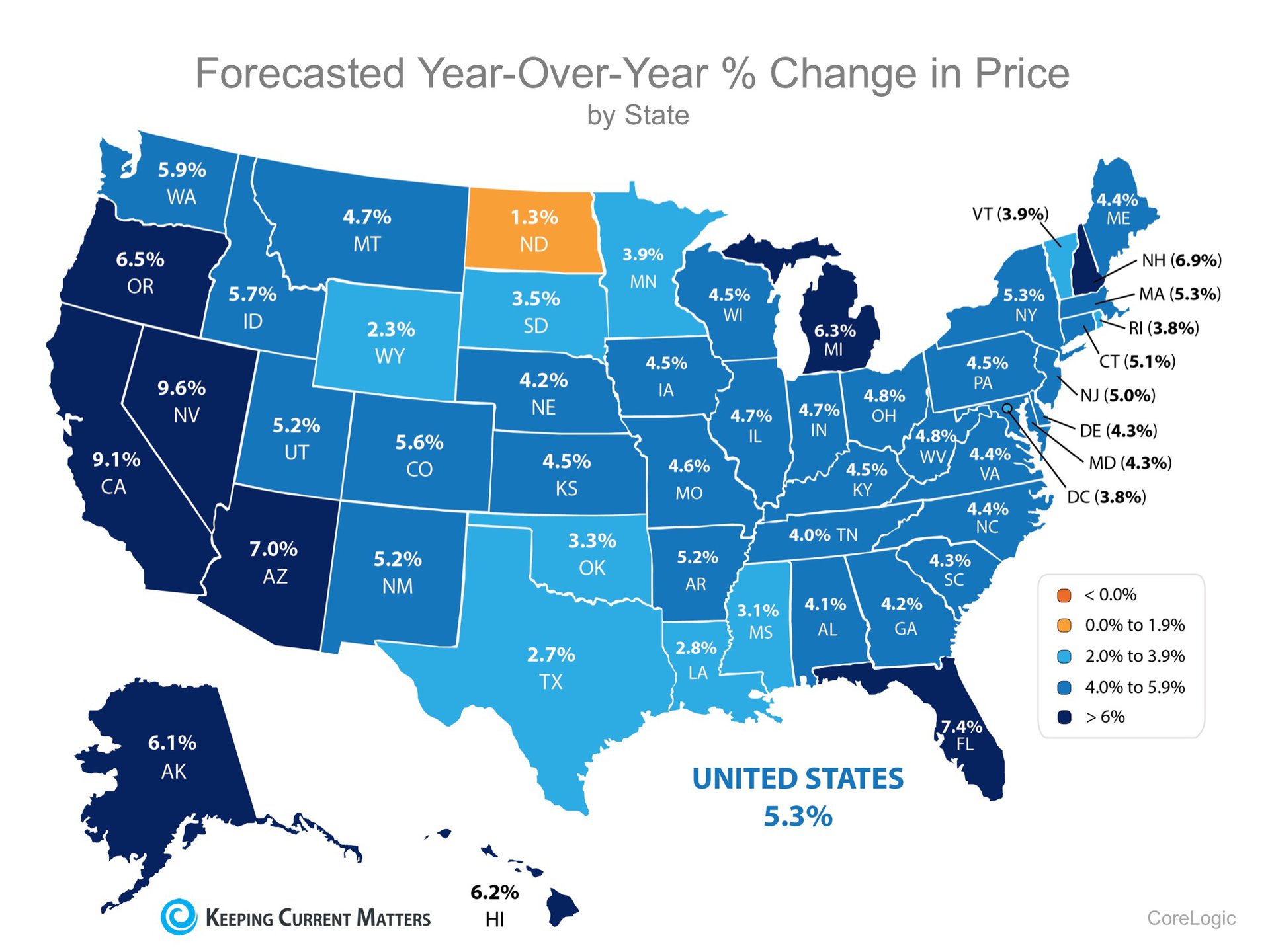

According to the latest Home Price Index from CoreLogic, home values are projected to increase by 5.3% over the next 12 months.

What does that mean to you?

Simply put, if you are planning on buying a home that costs $250,000 today, that same home will cost you an additional $13,250 if you wait until next year. Your down payment will need to be higher as well to account for the higher home price.

3. Where are mortgage interest rates headed?

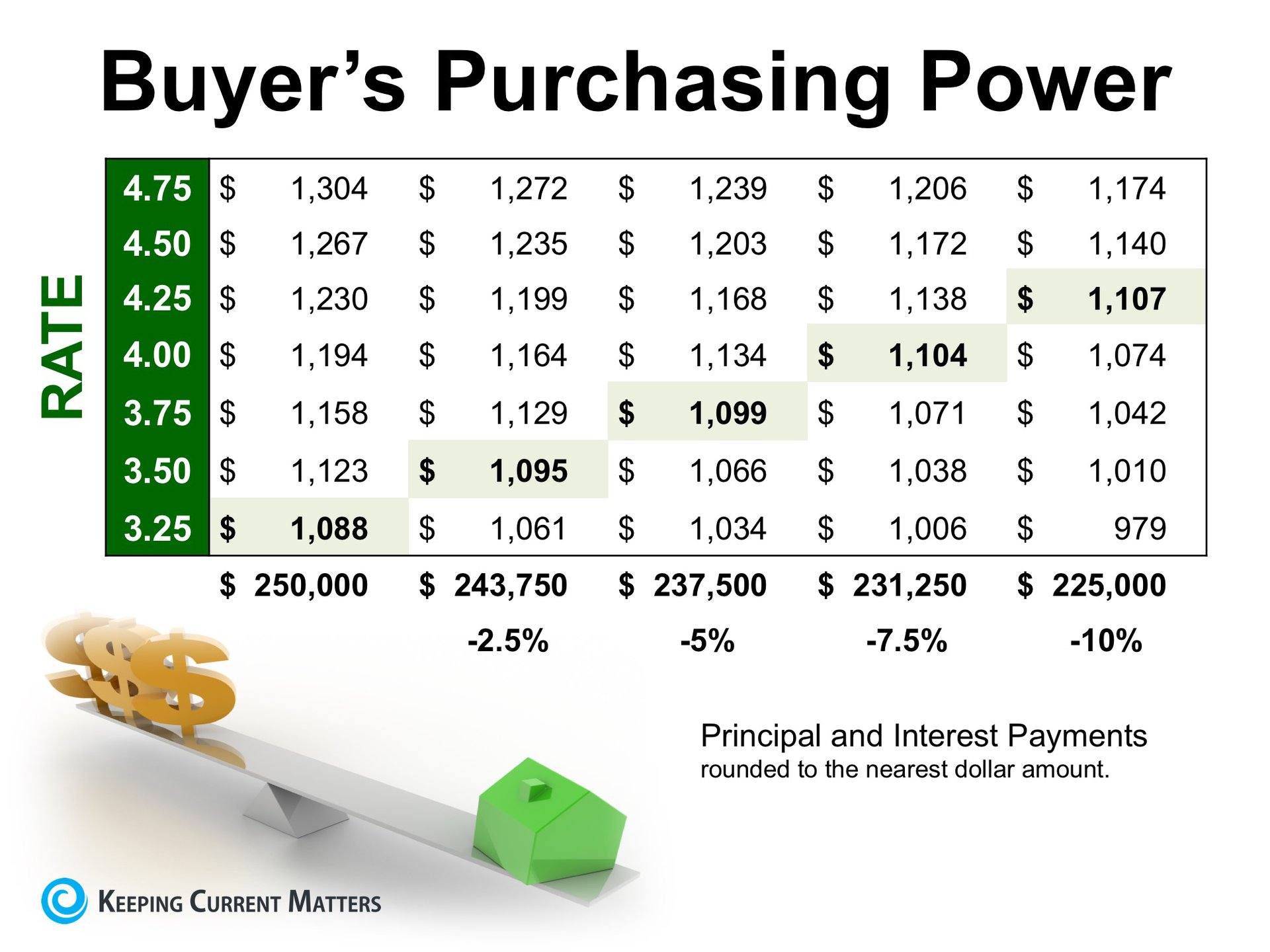

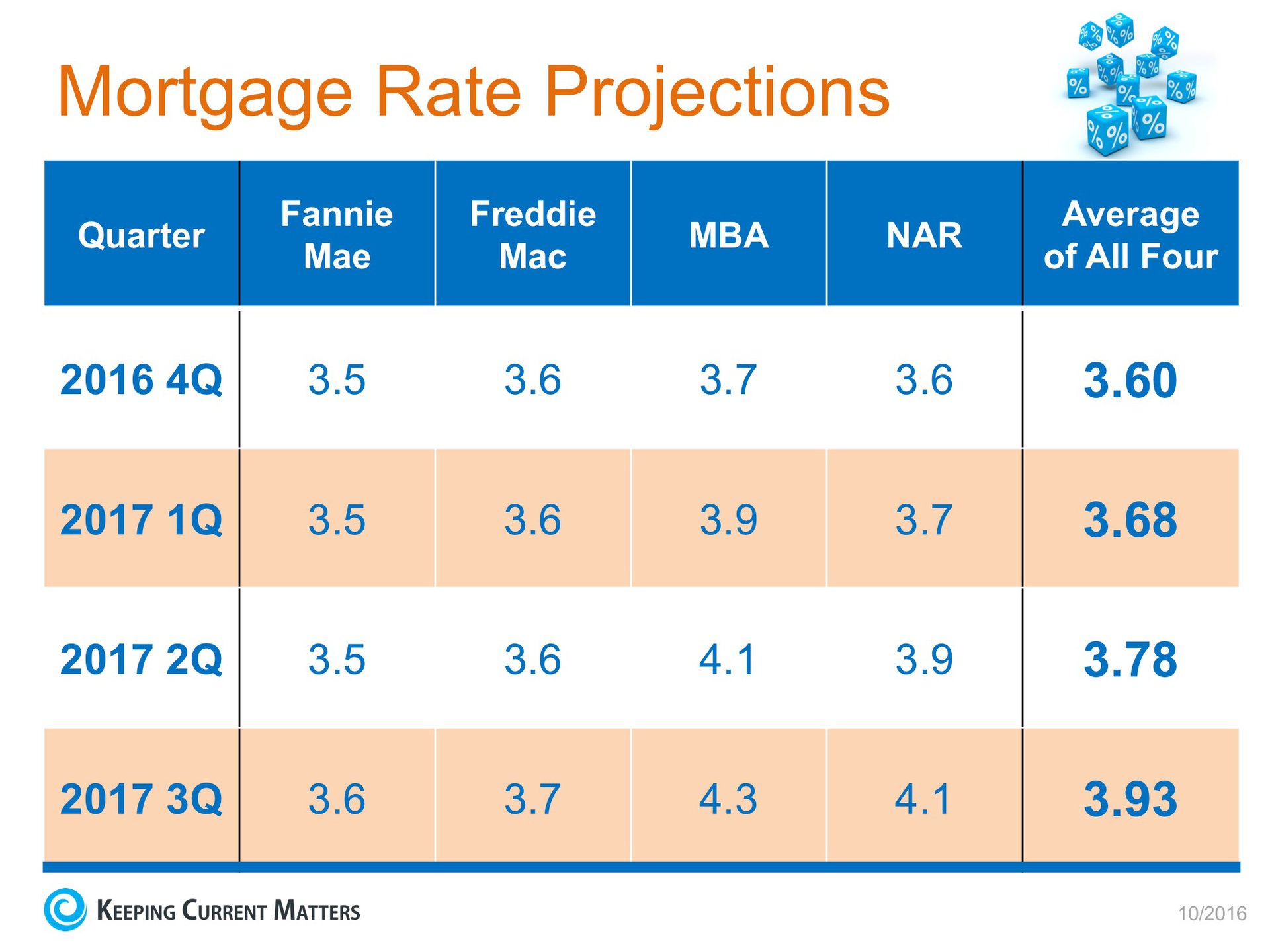

A buyer must be concerned about more than just prices. The ‘long term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

The Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac have all projected that mortgage interest rates will increase over the next twelve months as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

Whether you are thinking of Buying or Selling a Home contact a professional realtor who cares about you and your time. Contact Jay Cermak Top Fort Lauderdale Real Estate Agent at 954.235.3589 and schedule a FREE Real Estate Consultation today.